south dakota property tax abatement

Real Property Taxes. Tax amount varies by county.

South Dakota Property Tax Calculator Smartasset

South Dakota Department of Revenue.

. PropTaxInstatesdus 445 E Capitol Ave Pierre SD 57501 USA 605 773-3311 Document Signers. 2014 South Dakota Codified Laws Title 10 - TAXATION Chapter 18 - Property Tax Abatement And Refunds 10-18-1 Invalid or erroneous assessment or tax--Claims for abatement or refund-. The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000.

There is no authority in state law that allows for a. You can also call the Property Information. South Dakota property tax credit.

South dakota property tax abatement Friday March 4 2022 Edit. 1 The board may abate any or all of the delinquent taxes and penalty on real property if taxes remain unpaid and the property has been offered for sale as required by the code for two. The Department of Revenue has been asked whether a deferment or a delay of the payment of real property taxes is possible.

The first 50000 or 70 percent of the assessed value of solar energy systems less than 5 MWs whichever is greater is exempt from the real property tax. 1 COUNTY AUDITOR OFFICE Print. Then the property is equalized to 85 for property tax purposes.

Property Tax Abatement And Refunds 10-18-1 Invalid or erroneous assessment or tax--Claims for abatement or refund-. Go to the Property Information Search and enter your house number. Thus even if home values increase by 10 property taxes will increase by no more than 3.

A proposal to alter the text of a pending bill or other measure by striking. Local real property taxes in South Dakota vary from one to three percent of the market value of the structure with most rates falling around two percent. 2011 South Dakota Code Title 10 TAXATION Chapter 18.

Terms Used In South Dakota Codified Laws Title 10 Chapter 18 - Property Tax Abatement and Refunds. Then select Property Tax Statement. All property is to be assessed at full and true value.

If the county is at 100 of full and true value then the equalization. Any municipality county or township may defray the cost of abating a public nuisance by taxing the cost thereof by assessment against the real property on which the nuisance occurred or. 128 of home value.

Canton Industrial Park City Of Canton

(2)_Web.jpg)

Notice Of Increase Information June 17 2022 Announcements Nelson County North Dakota

Tangible Personal Property State Tangible Personal Property Taxes

Real Property Tax Exemption Information And Forms Town Of Perinton

Pdf Comparison Of Selected Nebraska Tax Incentives With Tax Incentives In Other States Kathryn Gudmunson Academia Edu

Would There Ever Be Any Property Tax Laws In States Created Where The Tax Would End Once The Property Itself Was Completely Paid For Quora

Property Tax Calculator Estimator For Real Estate And Homes

Webster Area Development Corporation Financing Incentives

State Tax Treatment Of Homestead And Non Homestead Residential Property

South Dakota Property Tax Appeals Important Dates Savage Browning

Property Tax South Dakota Department Of Revenue

Free Form Pt 38c Application For Property Tax Homestead Exemption Free Legal Forms Laws Com

Deadline Approaching For Elderly Disabled South Dakotans To Apply For Property Tax Relief

County Treasurers South Dakota Department Of Revenue

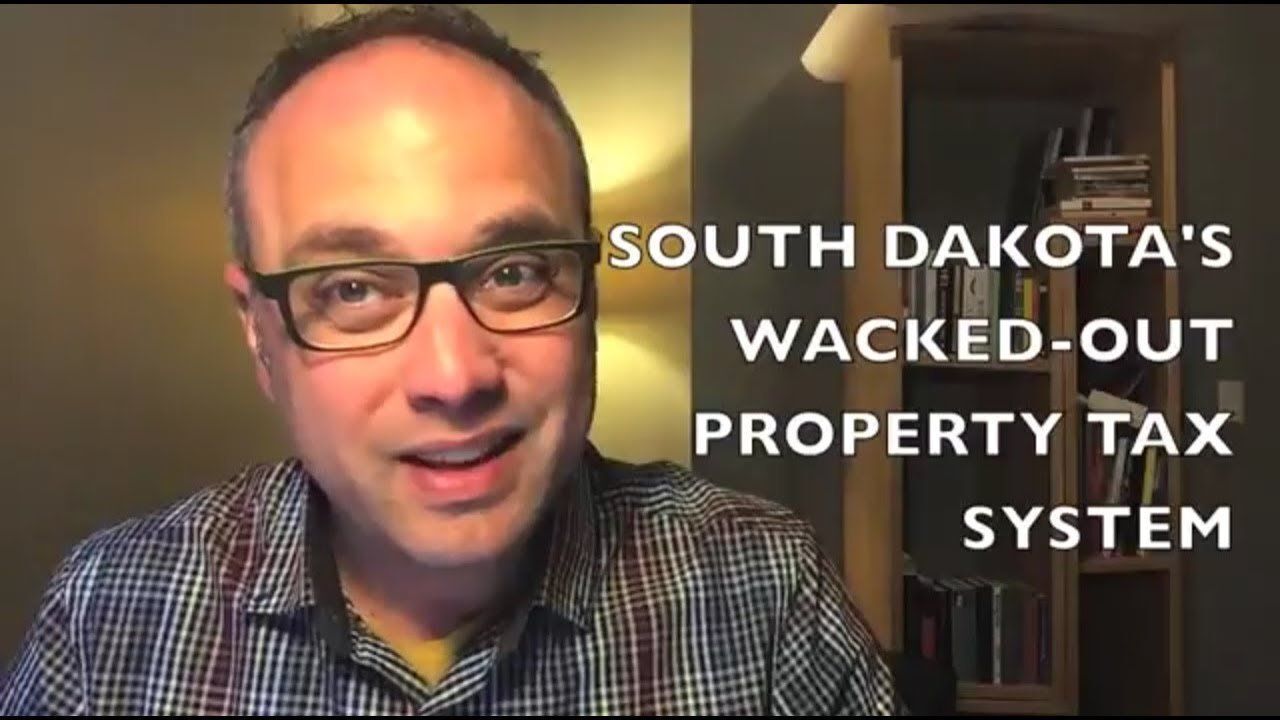

South Dakota S Wacked Out Property Tax System

States With No Income Tax Explained Dakotapost

Tangible Personal Property State Tangible Personal Property Taxes

Department Of Revenue Reminds Homeowners Of Property Tax Relief Deadline Knbn Newscenter1

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-0407c7e1645442deb4af9469534bd165.png)